It would usually involve two-to-three API calls to get that info. With REST or other APIs, you would have to first query all the invoices, query the corresponding customer for each of the invoice, and then write the email.

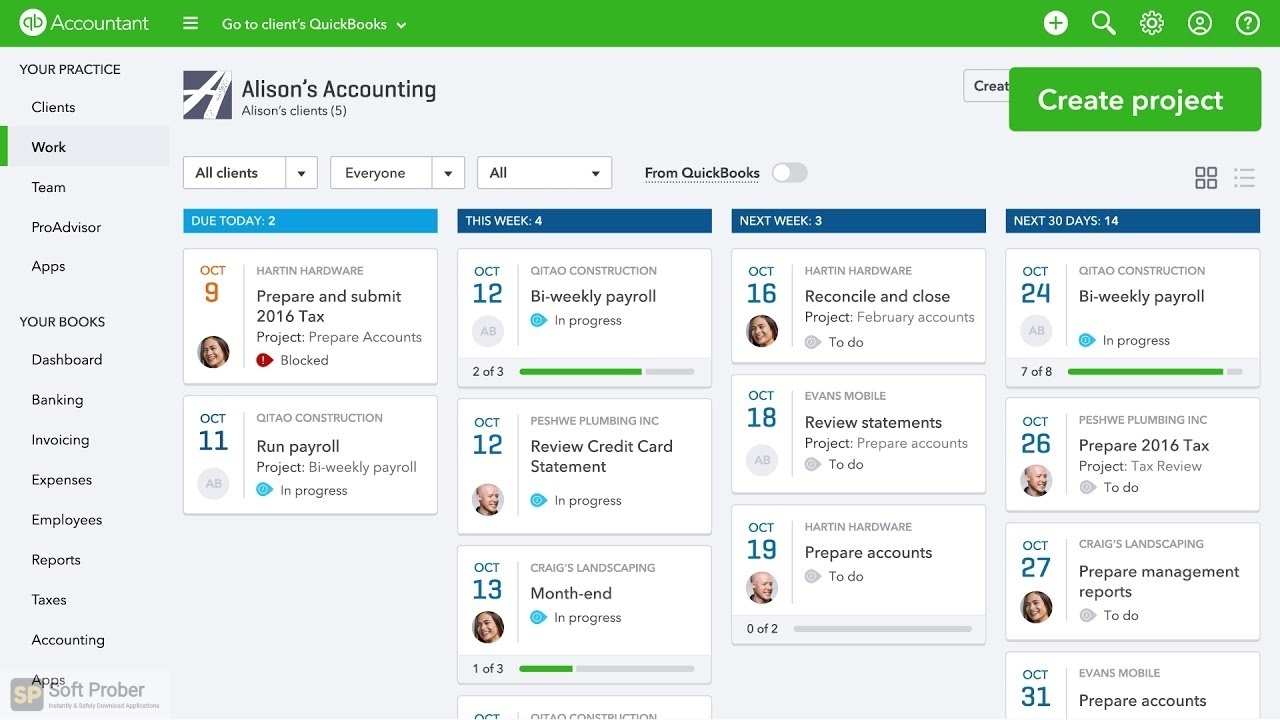

Say you want to get a list of all your pending invoices and send a reminder to the customers to make a payment. Let’s look at another advantage we already mentioned: getting many resources in one request (as compared with REST API or older APIs). As a developer, you won’t have to deal with a lot of unnecessary and additional fields. For example, if you only need a customer’s name and email, you can specify that in the request, and these are the two fields you’ll get back in the response. Unlike REST, which gives you everything in a customer’s schema when you make a call to get the customer’s data, GraphQL provides specifics. GraphQL is the next generation framework. The most common APIs right now are REST APIs. GraphQL queries also allow you to retrieve data across many resources in a single request while easily following references between them.įor developers, the genius of GraphQL is that results are predictable, and as notes, “Apps using GraphQL are fast and stable because they control the data they get, not the server.” Users can request specific fields from the API and get exactly what they requested-nothing more. It allows users to define their own APIs. GraphQL is a query language for APIs and a runtime to fulfill those specific requests. Before we do, we hope you’ll take a minute to read our first two posts, which provide a quick tutorial on getting started with the QuickBooks Online APIs and highlights chata.ai, a company that’s used our APIs to create a successful app.

QUICKBOOKS INTUIT SERIES

(They were removed in 2021.) I recently operated more than 80 stores in the United States and beyond.We’re wrapping up our three-part series on using the QuickBooks Online APIs by focusing on GraphQL, a next generation API.

Beginning in 1951, I kept my flagship store open 24/7 - installing locks on the door only due to the COVID-19 pandemic. My durable wares helped me thrive during the Great Depression. By the 1920s, I was mailing out a well-regarded catalog. This was followed by a Maine Duck Hunting Coat, which is still sold today (under a different name). I trace my roots back to 1911, when my founder (and namesake) created the Maine Hunting Shoe with a rubber sole. It’s generally best to steer clear of companies facing any meaningful risk of bankruptcy. But ensuring a company’s survival doesn’t mean doing well by all its shareholders. GM was indeed seen as too big to fail by many, and that’s why the government stepped in to help it survive. It emerged (as is common in bankruptcies) a newly reorganized company with new shares of stock - and holders of its old shares lost their entire stakes. In 2009, after trying hard to stay afloat, and despite accepting billions in government loans, GM filed for bankruptcy protection. However, the “down” periods have caused big trouble for many investors. Some see its stock today as appealingly priced, with a price-to-earnings (P/E) ratio recently in the mid-single digits, big sales of trucks and promising electric vehicle initiatives. For many years, it was the world’s largest automaker, by far - though it lost the No. The company weathered many boom and bust economic periods and even profited during the Great Depression, gaining market share. The Fool responds: General Motors’ history has had a lot of ups and downs since its founding in 1908. This book offers eye-opening stories about speculation in tulips in the 1600s, the 1929 stock market crash and day traders in the modern era. It’s helpful to understand how markets sometimes get carried away, creating booms that are followed by busts. This book will take you from ancient Greece to modern days, covering topics such as probability, risk, gambling and the growth of the insurance industry.ĭevil Take the Hindmost: A History of Financial Speculation by Edward Chancellor (Plume, $20). It offers illuminating business stories from the 1950s and 1960s about companies such as Ford Motor Co., General Electric and Xerox.Īgainst the Gods: The Remarkable Story of Risk by Peter L. Both Warren Buffett and Bill Gates have recommended this book. In this classic, Collins answers the question “Are there companies that defy gravity and convert long-term mediocrity or worse into long-term superiority?” by analyzing the histories of 28 companies.īusiness Adventures: Twelve Classic Tales From the World of Wall Street by John Brooks (Open Road Media, $35). Good to Great: Why Some Companies Make the Leap … and Others Don’t by Jim Collins (Harper Business, $35).

0 kommentar(er)

0 kommentar(er)